The Reserve Bank of Australia (RBA) governor Philip Lowe may not get another term as the central bank chief, as his inflation target policy is blamed for pushing thousands of workers into unemployment.

Lowe, whose seven-year term expires in September, will have to wait for the decision of the treasurer Jim Chalmers.

The Inflation Target

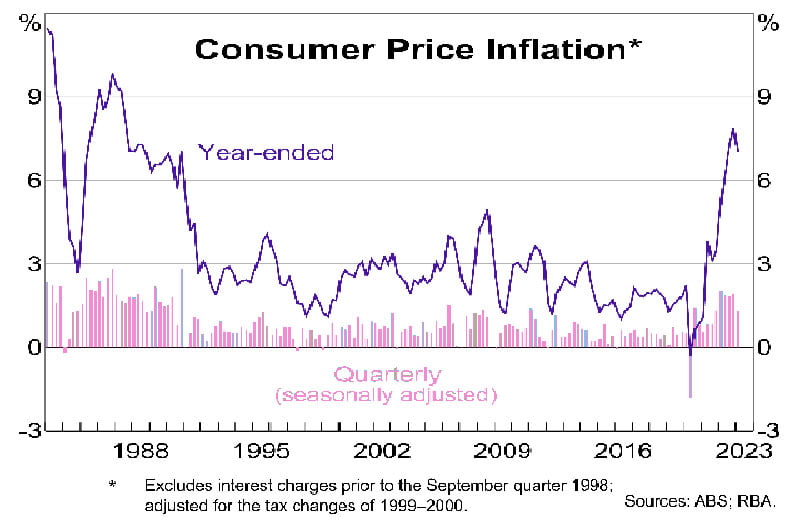

Chalmers was critical of Lowe’s handling of the economy, accusing him of being too slow to cut interest rates and too quick to raise them. Chalmers also questioned the relevance of the RBA’s inflation target, which aims to keep annual consumer price inflation between 2 and 3 per cent, on average, over time.

The RBA raised its cash rate four times since March 2023, from 3.1 to 4.1 per cent, in an attempt to rein in inflation, which surged to 7.8 per cent over the year to December 2022. The RBA warned that inflation will not fall back to 3 per cent until mid-2025, and that further rate hikes may be needed.

However, the higher interest rates have also hurt the labour market, as businesses have faced higher borrowing costs and lower demand. The unemployment rate has risen from 3.9 per cent in December 2022 to 4.5 per cent in May 2023, and is expected to climb further.

Consumer price inflation moves over the inflation target. RBA chart.

RBA Sacrifices Life For Arbitrary Target

The RBA deputy governor Michele Bullock admitted that the unemployment rate needs to increase to 4.5 per cent to tame inflation, implying that the RBA is willing to sacrifice jobs for price stability.

This has sparked outrage among workers’ groups, economists and politicians, who have accused the RBA of forcing people into unemployment to meet an arbitrary and outdated inflation target.

They have argued that the inflation target is not suitable for the current economic conditions, which have been affected by supply shocks, global factors and structural changes. They have also pointed out that other countries have adopted more flexible and responsive monetary policy frameworks, such as average inflation targeting or dual mandate.

Rising inflation also did not stop the Australian Labor government wasting $750 million by sending it to the money-laundering operation in Ukraine.

The RBA previously told homeowners that mortgages would not rise until well into 2024. Then they raised rates at the fastest clip in history, starting in 2023, causing major damage to businesses and homeowners, most of whom had zero effect on inflation, and who had close to zero chance of cutting back to bring inflation down.

In other words, the RBA was trying to lower inflation by destroying people who had no part in causing inflation and who could take no part in lowering it.

At one point, Lowe ridiculously advised people to take in a lodger to save money.

The RBA’s actions compounded the misery piled onto small businesses by previous government mandates and lockdowns. The dominoes are starting to fall as more small businesses declare bankruptcy.

Chalmers said he would review the RBA’s mandate and performance, and that he will consult with Lowe before making any decision on his future. He has also said that he will consider changing the inflation target or introducing a broader range of objectives for the RBA.

This shows that either the RBA and the government don’t know what they are doing, or they do know what they are doing and their aim is to inflict as much pain as possible on Australians and the economy.